Introduction to Irish Whiskey as an Investment

In the realm of fine spirits, Irish whiskey stands out not just for its smooth, complex flavours but also as a burgeoning avenue for investment. Known as “liquid gold,” this distinguished beverage has transcended its traditional role to become a coveted asset among collectors and investors alike. The allure of Irish whiskey lies in its rich heritage, meticulous craftsmanship, and the rarity of its most prized bottles, making it an increasingly popular choice for those looking to diversify their investment portfolios with tangible assets.

The global appreciation for Irish whiskey has surged in recent years, driven by a renaissance in craft distilling and a growing connoisseurship that spans continents. From historic brands that have whispered the ancient tales of Ireland through their spirits to new distilleries that bring innovative techniques and flavours to the fore, the market for Irish whiskey is as diverse as it is dynamic. This reawakened interest has not only elevated the status of Irish whiskey in the world of fine dining and spirits tasting but has also spotlighted its potential for yielding significant returns as a collectible.

Investing in Irish whiskey collectibles encompasses more than just acquiring bottles; it’s about understanding the story, the craft, and the rarity behind each one. Like art, the value of whiskey is subjective, yet certain factors such as age, distillation process, brand legacy, and exclusivity play a crucial role in determining its worth. As collectors seek out the rarest and most exceptional bottles, the market for Irish whiskey investments has seen remarkable growth, presenting both opportunities and challenges for those looking to enter this liquid gold rush.

This guide, “Liquid Gold: The Ultimate Guide to Investing in Irish Whiskey Collectibles,” aims to navigate the intricacies of the Irish whiskey market, offering insights into its history, the brands that dominate the landscape, and the strategies for curating a collection that not only appreciates in flavour but in financial value as well. Whether you’re a seasoned collector or a newcomer intrigued by the fusion of tradition and investment, this journey into the world of Irish whiskey collectibles promises to be both enriching and rewarding.

In recent years, the allure of investing in Irish whiskey has captured the attention of connoisseurs and investors alike, turning many towards the emerald isles in search of liquid gold. The investment appeal of Irish whiskey lies in its rich history, unparalleled craftsmanship, and the rarity of its finest expressions. As one of the world’s fastest-growing spirits, Irish whiskey offers a unique combination of heritage and innovation, making it a compelling addition to any investment portfolio.

A Spirited Renaissance

Irish whiskey’s journey from a casual drink to a collector’s prize mirrors its storied past and bright future. The spirit’s roots trace back over a thousand years, making it one of the oldest distilled beverages in the world. Despite its ancient origins, the Irish whiskey industry faced near extinction in the 20th century, only to rise from the ashes through the dedication of distillers who preserved the art of whiskey-making. Today, Ireland boasts over 30 distilleries, a testament to the spirit’s resurgence and the growing interest in its diverse flavours and styles.

The Investment Case for Irish Whiskey

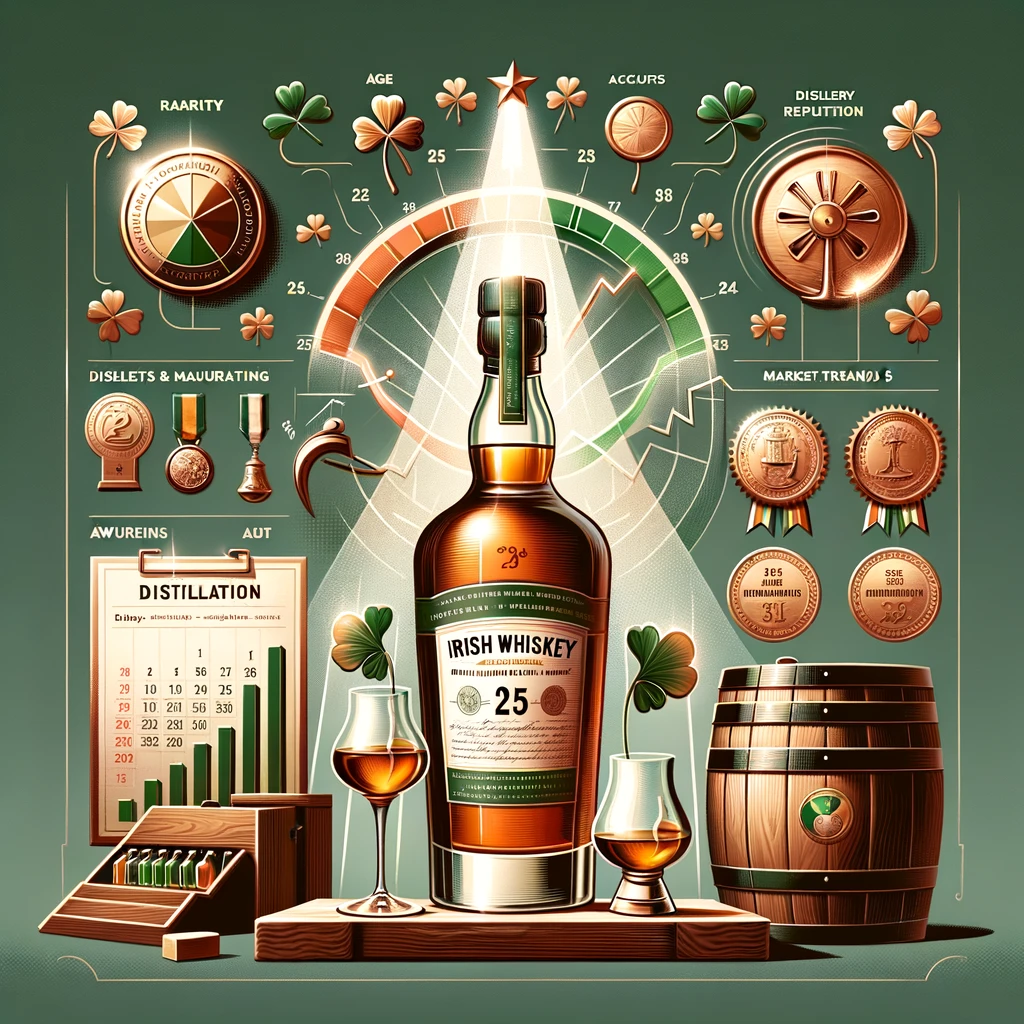

The case for investing in Irish whiskey is strong, driven by several key factors:

- Scarcity and Demand: Limited edition releases, especially from renowned distilleries, often sell out quickly and appreciate in value over time, fuelled by increasing global demand.

- Age and Maturation: Whiskey’s value typically increases with age, as the maturation process enhances its complexity and depth of flavour. Older, well-preserved bottles are particularly sought after.

- Brand Prestige: The reputation of the distillery plays a significant role in a whiskey’s investment potential. Bottles from historic and iconic brands tend to command higher prices.

- Awards and Recognition: Whiskeys that have received accolades or high ratings from respected industry bodies are more likely to be sought after by collectors and investors.

Building a Whiskey Portfolio

Investing in Irish whiskey is akin to curating an art collection. It requires patience, research, and a keen eye for potential. Here are a few tips for budding whiskey investors:

- Start with What You Love: Passion for the spirit itself should be the foundation of your collection. Focus on distilleries or styles you enjoy and learn about their investment potential.

- Diversify Your Selection: Just as with stocks, diversification can mitigate risk. Include a mix of established brands and promising newcomers in your portfolio.

- Keep an Eye on New Releases: Limited edition and special release bottles often have the highest appreciation potential. Stay informed about upcoming launches from your favourite distilleries.

- Storage and Preservation: Proper storage is crucial to maintaining and enhancing the value of your whiskey. Store bottles upright in a cool, dark place to preserve their quality.

As the world of Irish whiskey continues to evolve, so too does its appeal as an investment. Whether you’re drawn to the liquid’s rich history, its artisanal craftsmanship, or the thrill of the hunt for rare bottles, the market for Irish whiskey offers a fascinating opportunity to blend passion with investment.

Understanding the Market for Irish Whiskey Collectibles

The market for Irish whiskey collectibles is as intricate as it is invigorating, characterized by a diverse array of factors that can significantly impact the value of each bottle. For investors and collectors alike, understanding these nuances is crucial to making informed decisions and identifying bottles that not only enrich their collections but also have the potential to appreciate in value over time.

Rarity: The Jewel in the Crown

Rarity is perhaps the most straightforward factor influencing a whiskey’s collectability and value. Limited edition releases, especially those from closed distilleries or with a unique production story, are highly sought after. The fewer bottles available on the market, the more desirable they become to collectors, driving up their value. Additionally, single cask releases, where each bottle comes from a single barrel, offer a level of uniqueness that can’t be replicated, further enhancing their appeal.

Age and Maturation: A Testament to Time

The age of the whiskey, denoted by the number of years it has spent maturing in casks, plays a significant role in its valuation. Generally, the older the whiskey, the more valuable it is, given the enhanced complexity and depth of flavor achieved over time. However, it’s not just about how long the whiskey has aged, but how well it has aged. The conditions of maturation, including the type of cask used and the climate of the aging warehouse, can greatly affect the final taste profile and, consequently, the whiskey’s collectible value.

Distillery Reputation and Heritage

The reputation and heritage of the distillery are also key factors in determining a whiskey’s collectible worth. Bottles from distilleries with a storied history, particularly those that have ceased operation, are often more valuable. The legacy of the distillery, combined with the craftsmanship and quality of its whiskey, can create a powerful allure for collectors.

Awards and Critical Acclaim

Awards and recognition from respected industry bodies can significantly boost a whiskey’s profile and desirability among collectors. Whiskeys that have garnered high scores from notable critics or have won prestigious awards often see an increase in demand, which can drive up their market value. Such accolades serve as a testament to the whiskey’s quality and can help it stand out in a crowded market.

Market Trends and Consumer Interest

Finally, the overall trends in the whiskey market and shifts in consumer interest can influence collectible whiskey values. The growing global demand for premium spirits, coupled with an increased interest in artisanal and craft distilling, can affect which types of whiskeys become more valuable over time. Staying informed about these trends is essential for collectors looking to invest wisely.

Understanding the market for Irish whiskey collectibles requires a blend of knowledge, intuition, and passion. By considering these factors, collectors and investors can navigate the complexities of the market, making strategic choices that enhance the value and diversity of their collections.

Top Irish Whiskey Brands and Bottles to Collect

The landscape of Irish whiskey is dotted with distilleries that have mastered the art of whiskey-making, each offering something unique to those with a palate for liquid gold. Among these, certain brands stand out for their historical significance, unparalleled quality, and the sheer desirability of their bottles. Here’s a look at some of the top Irish whiskey brands and bottles that have captured the hearts of collectors and investors alike.

Midleton Very Rare

Launched in 1984, Midleton Very Rare is a pinnacle of Irish whiskey excellence. This annual release showcases the best of Midleton’s maturation warehouses, with each bottle being a blend of the finest whiskeys available. The scarcity of each vintage, coupled with the exceptional quality, makes Midleton Very Rare a must-have for any serious collector.

Redbreast 21 Year Old

Redbreast is synonymous with traditional Irish pot still whiskey, and the 21 Year Old stands as the oldest expression in their core range. This whiskey is celebrated for its complexity, balance, and the way it encapsulates the essence of single pot still whiskey. Its awards and critical acclaim have solidified its status as a collectible.

The Jameson Bow Street 18 Years Cask Strength

The Bow Street 18 Years Cask Strength is a tribute to Jameson’s storied history and craftsmanship. Matured in both bourbon and sherry casks and finished in first-fill bourbon barrels at the Jameson Distillery Bow Street in Dublin, this bottle offers a rich, full-bodied tasting experience. Its limited availability and unique finishing process make it a standout piece for collectors.

The Teeling 24 Year Old Vintage Reserve

The Teeling 24 Year Old Vintage Reserve is one of the oldest single malt Irish whiskeys available, making it a rare and exceptional find. It has won numerous awards for its quality and taste profile, which features hints of citrus, vanilla, and a light smokiness. Bottles from this limited edition release are highly sought after by collectors for their rarity and exquisite flavor.

Bushmills 21 Year Old

The Bushmills 21 Year Old is matured in three different types of casks: bourbon, sherry, and Madeira. This triple maturation process imparts a unique complexity and richness, making it one of the most celebrated Irish whiskeys. Its limited annual release adds to its exclusivity and appeal among whiskey investors and enthusiasts.

Each of these brands and bottles represents a unique story of Irish whiskey, from its rich heritage and meticulous crafting to its evolution into a globally acclaimed spirit. For collectors, these whiskeys are not just investments but treasures that embody the spirit of Ireland itself, offering both a taste of its storied past and a sip of its vibrant present.

Strategies for Building a Valuable Irish Whiskey Collection

Building a collection of Irish whiskey that appreciates in value over time is not just about acquiring bottles; it’s an art that involves strategic planning, a keen eye for quality, and a deep understanding of the whiskey market. Whether you’re a novice collector or looking to refine your approach, here are essential strategies to help you build a valuable Irish whiskey collection.

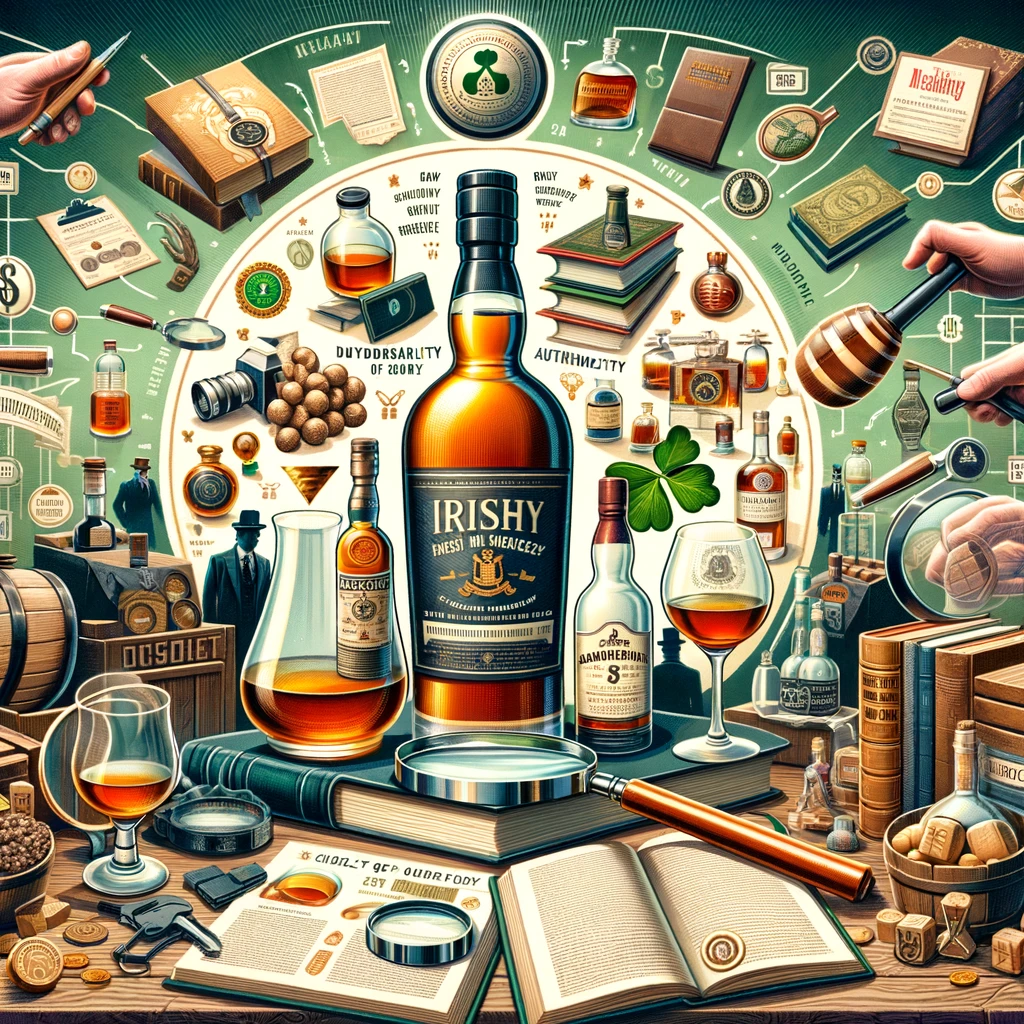

Start with Research

Knowledge is power in the world of whiskey collecting. Start by educating yourself about the different types of Irish whiskey, the history and reputation of distilleries, and what makes certain bottles more collectible than others. Familiarize yourself with market trends, auction prices, and expert reviews to inform your purchasing decisions.

Focus on Quality and Rarity

While the urge to rapidly expand your collection might be strong, focusing on quality and rarity will yield better long-term results. Seek out limited edition releases, bottles from closed distilleries, and whiskeys with unique production qualities. These types of collectibles are more likely to increase in value over time.

Authenticate and Verify

Authenticity is crucial in whiskey collecting. When purchasing, especially in the secondary market, verify the bottle’s provenance and ensure its authenticity. Look for original packaging, proper labelling, and any documentation that can confirm its legitimacy. This not only protects your investment but also enhances the collection’s overall value.

Diversify Your Collection

Diversity adds depth to your collection and can mitigate risk. Include a mix of bottle ages, distilleries, and whiskey styles. This not only creates a more interesting and varied collection but also spreads the potential for appreciation across different market segments.

Proper Storage is Key

How you store your whiskey can significantly impact its preservation and value. Store bottles upright to prevent the cork from deteriorating, away from direct sunlight, and in a climate-controlled environment to maintain consistent temperature and humidity levels. Proper storage ensures the whiskey’s quality remains intact, protecting your investment.

Network with Other Collectors

Finally, immerse yourself in the whiskey collecting community. Networking with other collectors can offer valuable insights, trading opportunities, and access to rare bottles. Participate in tastings, join forums, and attend auctions to stay connected and informed about the whiskey world.

By following these strategies, you can build a whiskey collection that not only brings personal enjoyment but also serves as a valuable investment. The journey of collecting Irish whiskey is as rewarding as it is fascinating, offering a taste of Ireland’s rich distilling heritage and the opportunity to own a piece of liquid history.

Navigating the Risks and Rewards of Whiskey Investment

Investing in Irish whiskey, like any other form of investment, comes with its own set of risks and rewards. Understanding these can help investors make informed decisions, potentially leading to significant returns while minimizing exposure to risk. Here’s how to navigate the intricate balance between the two in the world of whiskey investing.

The Rewards of Whiskey Investment

- Appreciation in Value: Well-chosen whiskey bottles can appreciate significantly over time, especially limited editions, rare releases, and bottles from closed distilleries.

- Tangible Asset: Unlike stocks or digital assets, whiskey is a tangible asset that you can enjoy aesthetically or even consume. Its value doesn’t rely on electronic systems or financial markets, offering a unique form of investment.

- Pleasure and Prestige: Beyond the financial gains, collecting whiskey offers personal satisfaction, enjoyment, and a sense of prestige, adding a qualitative aspect to the investment.

Understanding the Risks

- Market Volatility: The whiskey market can be unpredictable, with prices influenced by trends, consumer preferences, and global economic conditions.

- Authenticity and Condition: The risk of counterfeit bottles or damage to the whiskey due to improper storage can affect its value and resale potential.

- Liquidity: Converting whiskey investments into cash quickly can be challenging, as finding buyers willing to pay the desired price may take time.

Mitigating Risks

- Diversify Your Portfolio: Just as with traditional investments, diversifying your whiskey collection can help mitigate risks. This includes investing in bottles from different distilleries, regions, and price points.

- Stay Informed: Keeping abreast of market trends, new releases, and historical pricing data can help you make more informed decisions.

- Consider Insurance: For high-value collections, insurance can provide protection against loss, theft, or damage, safeguarding your investment.

Navigating the risks and rewards of whiskey investment requires a strategic approach, a deep understanding of the market, and an appreciation for the craft of whiskey making. With careful planning and a bit of patience, investors can enjoy both the tangible and intangible benefits of whiskey collecting, turning their passion for this storied spirit into a rewarding investment.

Conclusion

The journey into investing in Irish whiskey collectibles is as rich and rewarding as the spirit itself. From the historical distilleries of Ireland to the hands of collectors around the world, Irish whiskey represents a unique blend of heritage, craftsmanship, and investment potential. As we’ve explored the key aspects of this vibrant market, from understanding the factors that drive the value of collectibles, to identifying top brands and bottles, and strategizing to build a valuable collection, it’s clear that Irish whiskey offers more than just financial returns. It invites investors into a world of tradition, taste, and camaraderie.

However, like any investment, entering the whiskey market requires careful consideration, research, and a bit of caution. By navigating the risks and rewards with a balanced approach, collectors can enjoy the dual satisfaction of watching their investments appreciate while savouring the rich, complex flavours of some of the world’s finest spirits. Whether you’re drawn to the allure of rare bottles, the stories behind historic distilleries, or the simple pleasure of a well-aged dram, investing in Irish whiskey collectibles can add a valuable and enjoyable dimension to your investment portfolio.

In closing, remember that the world of Irish whiskey is ever-evolving, with new distilleries emerging and rare bottles continuing to capture the imagination of collectors. Staying informed, connected, and passionate about whiskey will not only enhance your collection but also enrich your journey through the spirited landscape of Irish whiskey investment. Sláinte!

Be First to Comment